What is wrong with my business? Why am I struggling? Why can’t I grow? Why am I losing customers? If you are asking yourself these questions and looking for the answers on your income statement and balance sheet, you are probably looking in the wrong place. May I suggest that the first place to look is in the bathroom mirror while you are shaving or putting on your makeup. After 37 years engaging with business owners, I have come to realize that the root cause of most business problems is not finances— it’s behavior. Our personal beliefs, attitudes and habits, our behaviors, are the foremost barrier to reaching the goals and objectives we have set for ourselves.

John believes he can sell his way to success— nevermind that his overhead is 150 percent of his gross profit and his current accounts receivable balance is 40 percent of his annual sales. He’s a strong salesperson but has little if any discipline or competence in the areas of planning, leadership, systems or finance. Great sales will never overcome bad behavior.

Tim’s 40-year-old family business is struggling to remain solvent. He spends 30 hours per week day trading to subsidize his personal income. Tim’s oldest son who works in the business says, “My dad is the most clueless person in this business.” Because of Tim’s complacent attitude, he failed to recognize that one division of his company had lost $750,000 over 36 months. Tim’s son was right. Complacency is a business disease as deadly as cancer.

Art has gone through four office managers in 18 months. Art is a perfectionist and requires everything within his business to be executed to his standard, which depends upon the day and his mood. (I expect we all know people like that.) Art’s desire is to remove himself from the operational responsibilities of his business. Good luck with that! Arrogance undermines everything it touches.

How can these businesses possibly grow and prosper with these types of behaviors? These behaviors need to change, but how? Changing one’s behavior is a difficult undertaking. Very few people make meaningful changes in their behavior. However, all great business leaders learn how to improve their behavior.

So, how can you improve your business behavior to achieve better results? Is there a set of metrics to measure improving business behavior? Is there a set of metrics to define positive improvements in business behavior? Yes.

To build a set of meaningful metrics to define improvements in business behavior, we must first establish clear definitions that are easily understood and represent recognizable signposts in the process of improving business competence both at an organizational level and at a leadership level. Measuring improving business behaviors can be defined in the context of various facets of a business that influence its growth, profitability and sustainability. These facets of business operations include planning, time management, conflict resolution, systems utilization, application of knowledge, dealing with mistakes, cash management and application of resources, to name a few.

Our observations focus on the behaviors of both leaders of businesses and their organizations. Our definitions offer simple descriptions of contrasting levels of business behaviors, competence and skill. We also identify contrasting characteristics of business’ cultures as they relate to improving methods of operation, systems, influence, profits and cash flow. As these ideas are presented in further detail, you will see a pattern emerge.

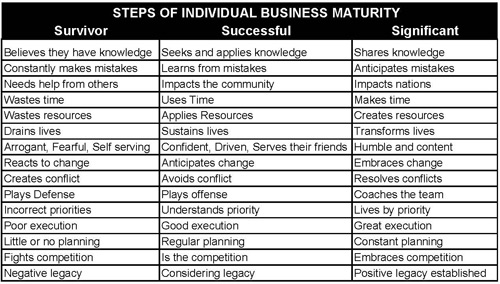

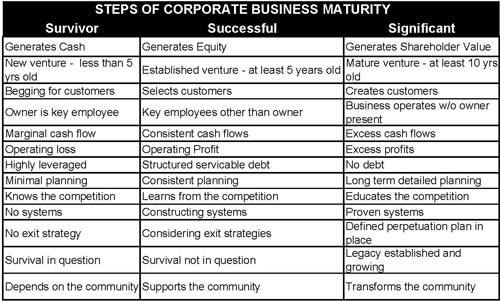

I have created three distinct business definitions to categorize behavior. These categories are: the “survivor” business, the “successful” business and the “significant” business. For each of these categories, I have established more than 30 separate illustrations to help define improving leadership and corporate behavior. Not all illustrations and detailed comparisons of the 30 categories are provided; however, a handful of the more meaningful examples are offered.

My comparative descriptions are designed to define three types of businesses. The survivor business is the emerging business that has not yet reached marketplace credibility or profitability on a consistent basis. The successful business has been around long enough that its survival is no longer in doubt. It is generating adequate profits and cash flow and meeting the needs and expectations of its owners, employees, vendors and customers. It has a presence in its community, but has limited ability to impact local or global culture. The significant business generates excess cash flow, shareholder value and consistent profits. It is a leader in its industry and a key employer in the communities it serves. It impacts not only its own community, but also the communities of its vendors, suppliers and customers. It has set the competitive bar for its industry peers. Significant businesses have the resources and influence to create sustainable cultural impacts. Significant businesses are household names like Walmart, Apple, Chick-fil- A and General Electric.\

These categories and comparisons come from a culmination of 37 years of observing more than 15,000 businesses and leading 13 different enterprises at some level of ownership or management. I created these characterizations to compare the characteristic behaviors of the survivor, the successful and the significant business to help my clients better understand how they needed to change their behaviors in order to take their businesses to the next level. These illustrations clarify what improving competent business behavior looks like and how it is developed over time.

The following charts contain concise, easily understood descriptions of the differences between the behaviors in the survivor, the successful and the significant business. This chart takes a particular subject, issue or business characteristic and describes how the behavior defines the competence level of the business owner or the organization. To provide further details on improving behavior comparisons, I have taken 10 selected topics from the preceding group and described the improving behavior further. These categories are time, equity, planning, systems, cash flow, change, competition, resources, mistakes and customers.

TIME

Everyone has 24 hours a day, seven days a week, 52 weeks a year. The difference between failure, success and significance is how we use our time. Emerging business owners beginning new ventures seem to have no time at all because there are so many things to accomplish. They never have time for everything that needs to be done. Those who manage time well become successful. Those who invest their time become significant.

EQUITY

Businesses in survivor mode strive to achieve positive cash flow. If they fail to meet that objective, they go out of business. National statistics indicate 67 percent of all startup businesses do not sustain positive cash flow and ultimately fail. Achieving and sustaining positive cash flow should be the highest priority of every startup enterprise. Successful businesses are built on sustained reinvested earnings. As their businesses grow, wise business owners dedicate a portion of their annual profits to the continued growth of their businesses. Prudently reinvested profits yield additional earnings in the future and serve to stabilize businesses and protect them from the adverse business cycles that ultimately impact every business. Significant businesses generate profits and increase shareholder value. Wise corporate leaders drive profits and shareholder value simultaneously. True wealth is only achieved by business owners who are able to sustain the increasing shareholder value of their businesses.

PLANNING

Planning is essential in completing any complex task, such as building a house, starting a business or winning a gold medal. A plan becomes a template or guideline by which you evaluate opportunities and make decisions. A plan gives you a target. If you aim for nothing you will hit it. A plan will help you build a business that serves you versus you serving your business. A plan will help you prioritize and focus your daily personal and business activities.

Survivors typically plan haphazardly if they do any planning at all. Sloppy planning results in sloppy work and little if any longterm value. Successful businesses perform consistent and detailed planning. Consistent planning and careful attention to detail results in outcomes that are noticed, appreciated and highly valued. Significant businesses perform consistent, disciplined planning as part of their daily activities. Their planning processes are robust and seek to challenge ingrained marginal performance and weaknesses that could cause the enterprise to lose profits and shareholder value.

SYSTEMS

Great businesses are built on great systems. Businesses that are dependent on people instead of systems are vulnerable to failure. A business in startup or survivor mode does not usually have any proven operating systems in place. One of the compelling reasons to purchase a franchise is to take advantage of the proven systems offered by the franchisor. For example, purchasing a Jimmy John’s franchise provides a startup business owner systems and processes that have been proven to work for other franchise owners. Many people believe the cost of purchasing a franchise is excessive. However, the cost of establishing those systems in your own business may be four to five times more than purchasing that franchise. If you are considering purchasing a franchise, it is advisable to look at those franchisors that have achieved success by adhering to established systems.

Successful businesses have built their own operating systems. Systems are in place for virtually every aspect of that business including planning, sales, marketing, human resources, finance, administration and leadership. Within a successful business there is a constant effort to improve systems and make them more efficient and effective. Successful companies study their competitors carefully to determine what systems they might be able to utilize in their businesses. Successful businesses constantly examine how their employees utilize and interact with their operating systems. A critical facet of any system within a business is the training provided to the employees to maximize the effectiveness of that system.

Significant businesses are built on tried and proven systems. However, danger exists when operating systems become too rigid and fail to adapt to changing technologies and marketplace conditions. Great companies constantly challenge themselves and work diligently to improve their operating systems. Great companies carefully measure the effectiveness and the productivity of their people and their operating systems, looking for any advantage they can gain by making their systems more efficient and responsive.

CASH FLOW

When I opened a commercial insurance brokerage firm, the greatest threat to my existence was marginal cash flow. When I billed a new customer, they typically paid immediately. However, existing customers who added vehicles or new exposures to their policies typically did not pay until they received a bill. In order to retain certain accounts, I was forced to extend credit for 30 days or longer. My company became a bank. Some of my customers promised to pay and never did. For every dollar that went uncollected, I had to sell $100 of new premium to make up for the $1 of bad debt. Cash flow was an everyday battle. Finding the money to pay my bills, including payroll every 15 days, was a constant struggle. I learned the hard way that I could not afford to be a bank. Once I decided to stop being a bank, my cash flow improved. I had to improve my behavior. No matter how valuable a customer was, I learned that I could not afford to keep them if they would not pay their bill in a timely manner. I learned how to fire those customers who wouldn’t pay their bills. I also offered premium finance plans for those who needed to pay their premiums over time.

Improving my behavior paid dividends. My cash flow very quickly became positive. I was spending less time dealing with accounts receivable and more time generating new business and taking care of reliable customers. Eventually, I arrived at a point where I had excess cash flow and was able to make investments in new opportunities, including acquiring additional insurance offices and hiring new employees.

Later in my insurance career, I became the president of an insurance company owned by a bank. The bank provided the funds to acquire an existing insurance agency. They also provided the funds to overcome 12 months of negative cash flow as I began to grow the company. After one year, I began generating positive cash flow and, over the next five years, grew the company from nine employees in three locations to 35 employees in five locations. That growth would not have been possible without excess cash flow. Businesses with excess cash flow have the luxury of choosing from among multiple opportunities to grow and prosper. Businesses with excess cash flow also have the luxury of having a positive impact on their employees, their communities, their nations and the world.

CHANGE

The one thing that is certain in life is that things will change. In business, change happens every day. How we react to change says much about our leadership and the maturity of our organizations. I recently had the privilege of meeting with the president of a prominent privately held company. Our conversation focused on how his company had changed over the past 60 years and how he expected it to continue to change over the next 60 years. He did not see his competition as his primary business adversary. His strongest adversary was the internal tendency within his own company to become complacent with the processes, systems and methods that have made it a significant company ($2 billion in revenues). He commented on how he viewed the subject of change within his company by saying, “When the rate of external change exceeds the rate of internal change, chaos is imminent.”

COMPETITION

Competition is everywhere. It is an integral part of business and life. Strong ethical competition in any industry serves to raise the bar of quality and service for the customer. Competition also gives businesses the opportunity to differentiate themselves from their peers. How businesses respond to competition clearly defines the status of their existence. Why would a significant business embrace competition? The answer is quite simple. It provides an opportunity to establish a differentiated competitive advantage.

RESOURCES

Resources come in many forms: time, money, relationships, raw goods, talents, skills, knowledge, experience, ethics, morals and convictions. As a business owner, your primary objective is to deploy the resources at your disposal as efficiently as possible to create profits and additional resources. One of the cornerstone realities of a free market system is He who makes the best use of the resources at his disposal makes more resources.

A startup business does not typically recognize what resources it has at its disposal let alone how they should be deployed. One of the most compelling reasons for writing a business plan is to organize the resources at your disposal and be sure they are not wasted. An emerging business usually has limited resources—the most limited being time and money. Businesses in survivor mode consistently waste their resources because they lack the planning, knowledge and experience necessary to know how to put those resources to the best possible use. Significant businesses create new resources. When a business reaches a certain critical mass and a consistent level of profitability, it has the luxury of creating new resources. This might include accumulating operating capital to acquire a competitor, opening a new product line or investing in additional training for key employees.

MISTAKES

Mistakes are inevitable, but repeating the same one is inexcusable. Failing to recognize and correct them can be fatal. Businesses can fail because of one or more intentional mistakes or because of lying, cheating or stealing. It can happen in any type of enterprise. The first challenge with any mistake is to admit that you made it. In recent years, we have witnessed moral and ethical lapses at the highest level of business. These mistakes caused incredible loss and heartache to the employees, stockholders and customers of those companies. Moral and ethical accountability should be a requirement at all levels within every organization.

Truly great businesses expect and anticipate mistakes and install systems and processes to deal with them appropriately. While running an insurance operation for a bank holding company, I built a series of specific boundaries around human error. I first recognized the difference between an error of omission versus an error of commission. An error of omission was inadvertently leaving out an item, letter or numeral. Given the volume of transactions in the course of everyday business, transactional errors happened. Our employees were well trained, experienced and made very few errors. The rule was those who created them were expected to report them and repair them. Our staff worked diligently to keep transactional errors to a minimum and make sure the cost of those errors was minimal. These types of errors where not fatal or expensive.

Errors of commission served to reveal weaknesses in the training of our employees. When our staff said or did the wrong thing, management was ultimately responsible for that mistake. Depending on the role of the employee and his level of responsibility, those errors could be devastating or fatal to a company. Some mistakes cannot be tolerated, especially when they are intentional or violate the principles of the company.

CUSTOMERS

The role of the of insurance sales representatives in our organization was defined by the context of the type of customers they served. They were known as the “rookie,” the “pro” or the “superstar” (survivor, successful, significant).

The rookie, or brand-new insurance sales professional, was expected to write insurance on anything that walked, talked and paid a premium. As rookie representatives, they had not yet earned the right to be selective about their customers.

The pros, who had usually been in the business a minimum of five years, earned the right to select their customers. As pros, they typically had long-term client relationships. Pros went to great pains to be sure that those relationships were served efficiently and professionally.

Superstars typically operated in specific vertical markets and had unique products or services that attracted and created new customers. The superstars identified needs for differentiated insurance products or services that solved unique problems within the insurance marketplace. Once the unique insurance products or services were offered, they automatically attracted new customers.

So, where are you? Which of these descriptions best describes your behavior and the behavior of your enterprise? Take a few minutes to realistically assess which description best fits you and your business. Are you in survivor mode, successful mode or significant mode? You are most likely better at some of these behaviors than others. (For example, you may be successful in the customer category and a survivor in the planning category.) Once you have evaluated yourself and your business, decide what you and your organization need to change in your behavior to take your business and your leadership to the next level.