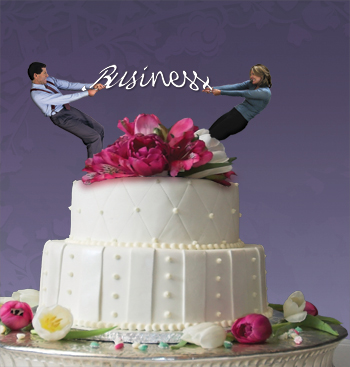

Divorce takes an emotional toll on all people involved—family, friends and, for business owners, employees who are concerned about distractions and decisions that may impact the company. No doubt financial concerns weigh heavily too in all stages of this life-changing event, making it challenging for even the most conscientious business owner to stay focused on every priority. There are a few steps you can take now, however, that may make the process less stressful and distracting.

Addressing the suspicion of R.A.I.D.S. One particularly challenging issue facing business owners who are going through a divorce is the suspicion of R.A.I.D.S.— Rapidly Acquired Income Deficiency Syndrome. R.A.I.D.S. is usually suspected when the supporting spouse’s income suddenly, and usually without valid explanation, drops substantially. During a recession, finances must be even more thoroughly scrutinized to rule out R.A.I.D.S. because a supporting spouse’s income may drop naturally, especially if he or she is a small business owner, receives regular bonuses or has commission-based income. While there may be legitimate reasons for the income decline, it does raise the suspicion that income may have been manipulated to reduce an alimony or child support obligation. Matrimonial attorney, Charles F. Vuotto, Jr., Esq. comments that New Jersey cases have even recognized that the income of a small business owner must be more closely scrutinized. (See Larbig v. Larbig, 384 N.J. Super.17, 23 (App. Div. 2006)).

Forensic CPA Scott Maier of the accounting firm Friedman, LLC, frequently helps divorce attorneys determine whether a reduction in income was permanent, temporary, contrived or real. His advice to the person who would be paying support is to keep accurate and detailed records and be very honest with his or her spouse, often referred to as the non-titled spouse.

Scott’s advice to non-titled spouses is to start paying attention. “If our client suspects that his or her spouse is hiding income, we advise them to start keeping very accurate records,” says Scott. “Get a separate computer, separate e-mail address, separate P.O. box, etc. That will help us determine how honest the other spouse is.”

Minding your own business According to Mr. Vuotto, another challenging consideration is how business assets should be treated in a divorce. “Here too, the court typically looks at past activities, including how the assets were treated during the marriage,” he says. “Since there are so many possible scenarios, including pre-nuptial agreements and the number of owners involved, a business owner should seek the advice of a divorce attorney to factor that into his or her personal financial situation.”

As Vuotto explains, the two main problems a business owner will face when dealing with divorce is the concept of the “double-dip” and the “standard of value.” As to the “double-dip,” the business owner must realize that in New Jersey and many other jurisdictions, the experts will likely value the business using the same stream of income from which alimony and child support will be paid. Further, in New Jersey and some other states, courts will apply a “Fair Value” standard of value rather than “Fair Market Value. ” The use of “Fair Value” instead of “Fair Market Value” will result (in most circumstances) in no minority interest or marketability discounts being taken, thereby increasing the distributable value of the business.

Keeping long-term goals in sight A recent Morgan Stanley Smith Barney report entitled, How can I take control of my financial life after my divorce? focuses on long term issues that must also be considered. According to the report, although your current situation may demand most of your attention, it is important not to lose sight of your long-term goals and financial needs, particularly as you negotiate a settlement. For example, your retirement goals are an important and valid concern. The terms of your settlement may also trigger financial changes if you remarry. In the area of estate planning, you should review any will you have drawn as well as any trusts that you established with your spouse. Certain trusts can protect your children’s inheritance if your former spouse should remarry. If you have done any irrevocable charitable planning, you may be able to divide your charitable trust or family foundation between you and your former spouse.

But the financial impact that a divorced couple experiences goes beyond their investment portfolio. No doubt there will be new financial goals that will require a comprehensive approach and will require wealth management, not just investment management. After all, as noted earlier, you will have to address your advanced planning needs, including wealth enhancement, wealth protection, charitable giving and wealth transfer, which usually get redirected following a divorce.

Putting a financial team in place Such a wide range of financial needs requires a wide range of financial expertise. Because no one person can be an expert in all these subjects, the best wealth advisors work with networks of experts—financial professionals with deep experience and knowledge in specific areas. Effective wealth advisors, then, are experts at relationship management—first building relationships with their clients in order to fully understand their unique needs and challenges and then coordinating the efforts of their professional networks in order to meet those needs and challenges. Wealth advisors must also work with their clients’ other advisors— such as attorneys and accountants— in order to ensure optimal outcomes.

If you are contemplating divorce and need to make important and new near- and long-term decisions, you need to deal with a true, experienced wealth advisor. How will you know whether you are dealing with a true wealth advisor? First, he or she should offer a full range of financial services, including the four areas of advanced planning mentioned here—wealth enhancement, wealth protection, charitable giving and wealth transfer. The wealth advisor should be backed by a network of professionals to provide these services. Second, the wealth advisor should work with you on a consultative basis. This allows the wealth advisor to uncover your true financial needs and goals, to craft a long-range wealth management plan that will assist in meeting your needs and goals, and to build an ongoing relationship with you that helps ensure that your needs are met, even as they change with your marital status.

This consultative process usually unfolds over a series of meetings.

- At the discovery meeting, the wealth advisor determines your current financial situation, where you want to go and the obstacles you may face in achieving what is important to you.

- At the investment plan meeting, the wealth advisor, using the information he or she gathered at your first meeting, presents a complete diagnostic of your current financial situation and a plan for achieving your investment-related goals.

- At the mutual commitment meeting, assuming that the wealth advisor can truly add value, both you and the wealth advisor decide to work together. You now officially become a client.

- At the initial follow-up meeting, the wealth advisor helps you organize your new account paperwork and answers any questions that may have arisen. (It is after this meeting that an Investment Policy Statement is created.)

- At regular progress meetings, which are typically held quarterly, the wealth advisor reports to you on the progress you’re making toward achieving your goals and checks in with you on any important changes in your life, such as a divorce, that might call for an adjustment to your investment plan. At subsequent progress meetings, you and your wealth advisor decide how to proceed on specific elements of the wealth management plan. In this way, over time, every aspect of your complete financial picture is managed effectively.

Getting through it all While all this information can help you start to think through key issues, a qualified financial team, including a wealth advisor, an attorney and an accountant, can help you deal with the intricacies of planning, both for short-term realities and long-term possibilities.

Brilliant content indeed! As a lawyer, I strongly believe that if business owners follow these steps carefully they should make the separation process less stressful and distracting. Thanks for all this information can help business owners start to think through key issues and deal with the intricacies of planning, both for short-term realities and long-term possibilities.