Navigating the financial landscape as a fledgling business can be daunting, especially when traditional paths require proof of operational success. Alternative avenues, like those listed in the Strategic Working Capital Sourcing Strategies for the Survival of Small Businesses published by Walden University in 2018, are available to help organizations bypass the need for robust sales and trading records. Rather than emphasizing past success, these innovative methods prioritize future potential and strategic planning. By understanding the traditional and non-traditional funding options available, companies still in their formative stages or weathering challenging times can secure the resources they need to fuel growth and success.

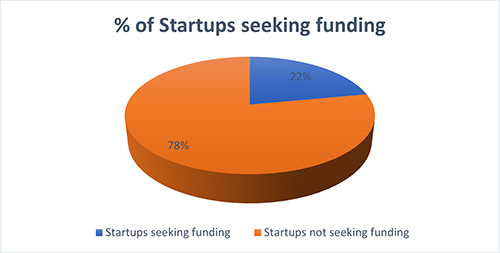

According to the fall 2019 edition of SCORE’s The Megaphone of Main Street: Startups, mentors commonly recommend starting businesses with at least three to six months of financial reserves. The article also states that only 22 percent of startups sought outside funding that year. (Figure 1) Traditional lenders and financial institutions place significant importance on assessing risk when considering business funding. They require evidence of six months of operational capital, which serves various purposes such as proving financial stability, demonstrating effective cash flow management, mitigating risk, assessing operational viability, following historical practices, accounting for market fluctuations, validating the concept, and ensuring a viable business plan. This is one reason many startups do not seek funding.

Figure 1: Percentage of startups seeking funding

Alternatives to obtain working capital

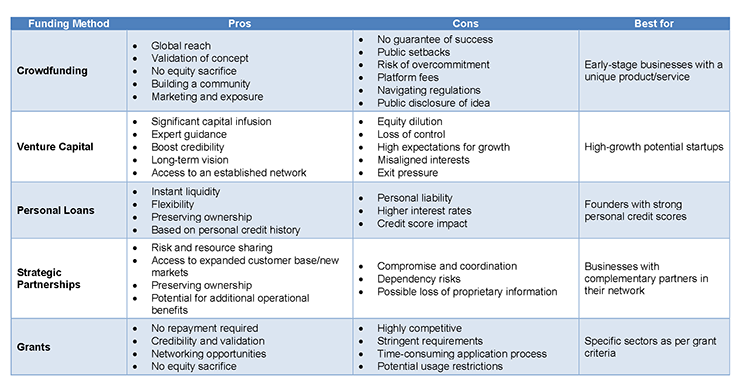

In 2015, the article “New Approaches to SME and Entrepreneurship Financing: Broadening the Range of Instruments” by OECD lists many alternatives to this common practice, though each has pros and cons. Every business needs to determine what alternative(s) best suit its needs (Figure 2).

Crowdfunding has revolutionized the way startups secure capital. This increasingly popular method involves collecting small contributions from numerous people, typically through global online platforms.

- Global reach allows businesses to expand their potential lender pools, and campaigns enable companies to retain equity in exchange for pledges. These campaigns serve as powerful marketing tools.

- Cons. Many crowdfunding efforts fail to achieve financial goals due to factors such as poor presentation or market saturation. Unlike private negotiations, failed crowdfunding campaigns are public, potentially affecting a company’s reputation and future funding prospects.

Venture capital offers the opportunity for early-stage startups with the potential for rapid growth. Backed by a pool of investors, venture capitalists provide significant capital infusion in exchange for equity.

- Startups can turbo-charge their growth strategies, scale operations, attract top talent, and expand into new markets. This adds credibility and prestige, making it easier to attract partners, customers, and additional investors.

- Cons. Founders and early investors may see their ownership percentage diluted, which can impact decision-making authority and future profits. With a significant stake in the company, venture capitalists often share a voice in strategic decisions, sometimes leading to disagreements over the company’s direction.

Personal loans and strategic partnerships can be an inventive way for businesses to secure funding.

- Pros. Personal loans provide instant liquidity to jumpstart or sustain business operations seamlessly. Strategic partnerships allow for financial and operational risk-sharing, resource pooling, and sharing the operational and financial burdens, which can amplify growth and expansion into new markets.

- Cons. With personal loans, the business owner is personally responsible for repayment, even if the business fails, which could lead to personal financial strain. Sharing business insights, data, or strategies in strategic partnerships may raise concerns about confidentiality and intellectual property rights.

Grant opportunities targeted at nascent businesses or those with specific purposes are available through various federal, state, and private organizations.

- Pros. Unlike loans, grants don’t need to be repaid, offering financial relief for businesses just starting out, and can serve as validation of a business idea or model, enhancing credibility. Grants don’t require giving up any equity in the business, meaning the founder can maintain complete control over the company’s ownership.

- Cons. Grants, especially high-value ones, are highly sought after, and involve a rigorous application process with fierce competition. They come with specific conditions and reporting obligations, and applying for grants can be time-intensive, demanding detailed business plans, financial projections, and supporting documentation.

Many organizations host business plan competitions, where the winning idea receives a monetary reward and support for executing its concept. For businesses that require specific equipment or machinery, equipment financing allows them to finance that equipment directly rather than securing broader capital. Companies can also access angel investors, microloans, community development financial institutions (CDFIs), royalty financing, profit-sharing, and other alternative options.

Figure 2: Alternative funding methods

Making a case for funding

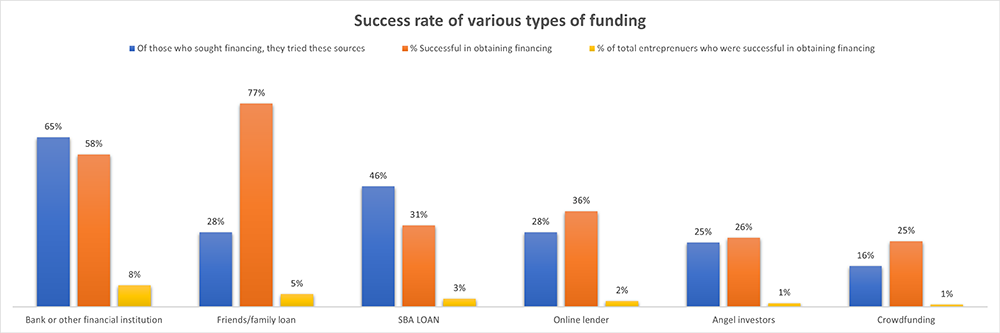

For businesses that want to maximize their chances of securing funding, following practices that stem from a blend of thorough preparation, adaptability, and strategic networking are critical (Figure 3). An organized, clear, and comprehensive business plan is paramount. It should lay out the company’s vision, strategies, financials, and growth projections, acting as a roadmap to convince potential investors of its worth. Understanding investors’ priorities, preferences, and past investment patterns means tailoring request pitches to resonate with their specific interests and concerns.

Figure 3: Success rates of various types of funding

Businesses with higher chances of success back up all financial and market projections with solid evidence, using market research, pilot programs, or other test cases to validate the business’s potential. Especially for those with innovative products or services, showing a working prototype or detailing positive results from beta tests can be influential. Being upfront about challenges, past failures, or uncertainties is crucial, while honesty and transparency build trust and showcase analytical and problem-solving abilities.

Preparing a detailed dossier on all aspects of the business for investors who might want to dive deeper includes obtaining financials, employee contracts, intellectual property (IP) rights, and more. It is vital to be open to feedback and willing to adjust the business model, strategies, or projections based on valuable insights from potential investors. After the initial pitch, keeping potential investors updated on any major developments or milestones achieved shows progress and keeps the business on their radar.

The landscape of alternative funding is dynamic and ever evolving, influenced by technological advancements, economic shifts, and changing investor priorities. The Forbes article titled, “Small Business Loan Statistics And Trends 2023,” shows that from 2019 to 2021, a nine-percent drop in the number of small businesses applying for loans indicates that many organizations are opting for alternative finance options. The future of alternative funding will be characterized by diversity, flexibility, and adaptability, catering to a broader array of startups and business needs. Also, the potential use of artificial intelligence (AI) to match startups with investors based on a myriad of criteria is a cutting-edge approach that could streamline the investment process and increase the likelihood of successful matches. As regulations catch up with innovations and investors become more open to novel financing models, startups will have a broader spectrum of options, allowing them to find the perfect fit for their business model and growth stage.